U.S. News & World Report Names Pomperaug Woods Among Connecticut’s Best Nursing Homes for 2025

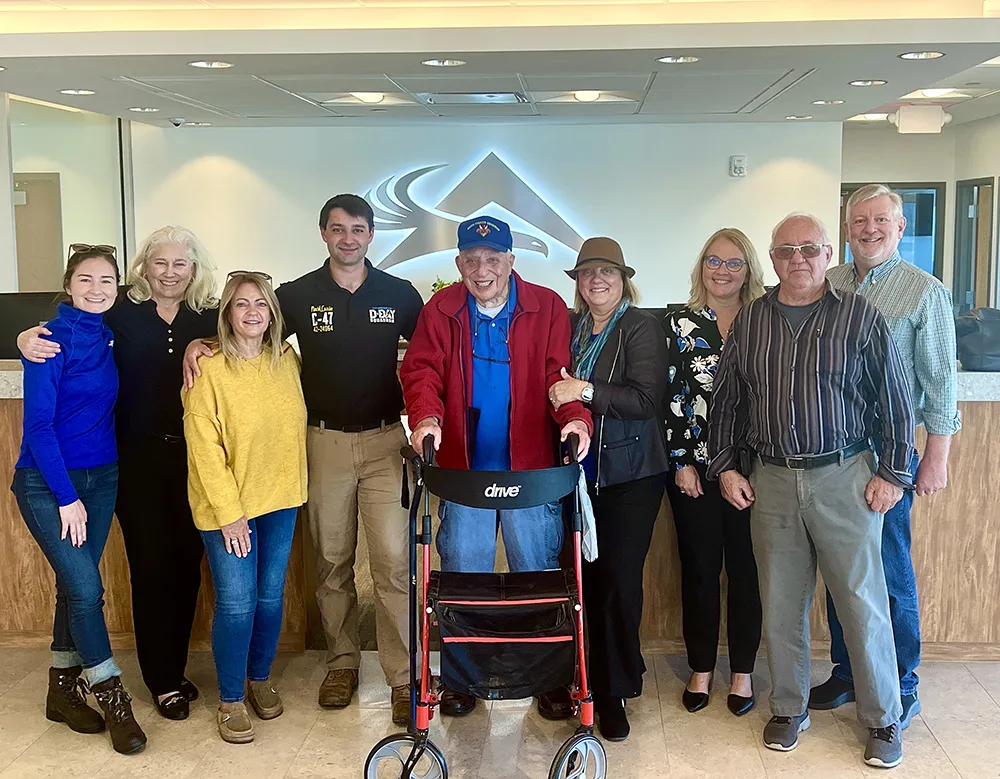

WTNH News 8 – World War II Pilot Reflects on his Last Flight of the War

U.S. News & World Report Names Pomperaug Woods Among Connecticut’s Best Senior Living Communities for 2024.

Pomperaug Woods’ Management Company becomes J.D. Power’s most awarded brand in the history of its Senior Living Satisfaction Study

Do your future plans safeguard against changing needs?

Understanding the likelihood that even older adults in good health may need long-term care as they age can be a pivotal first step in building a dependable plan for the what-if’s of life. So let’s start with this:

That’s the chance healthy 65-year-old couples will have at least one partner who requires significant long-term care as they age.

While home health care stands as a preferred option for many, the expense of such services can quickly escalate. For those 44 hours a week, seniors can expect to pay more than $50,000 annually. However, if more hours of service are needed, home health care can easily and significantly exceed the annual cost of a nursing home.

Is the average cost for 84 hours per week or 12 hours of daily care. If changing needs require 24/7 support, that average annual cost rises to $215,376. When considering the costs of long-term care — whether provided at home or in a nursing facility —it’s important to also think about the role geography can play. In areas of the country with higher-than-average overall cost of living, the amount seniors can expect to pay for care services will be higher than the national average.

It’s never too early to look ahead.

Health changes can happen out of the blue. That’s why it’s important to proactively consider how a Life Plan Community and the right insurance can prepare you for whatever tomorrow has in store.

Download our free guide here to learn more.

5 Benefits of Downsizing to a One-Bedroom Apartment for Seniors

Downsizing to an apartment for seniors has many benefits. If you’re living in a large house with unused rooms, a smaller home is simply more comfortable and maintaining it is less stressful. There are fewer rooms to clean, and utilities are cheaper. A maintenance-provided lifestyle in a community like Pomperaug Woods also means you won’t have household chores like painting, mowing or shoveling snow to worry about. Here are 10 benefits of downsizing to an apartment for seniors you may not have anticipated:

1. You’re Not Tied Down with a Mortgage

In a Life Plan Community like Pomperaug Woods, you pay an entrance fee and a monthly fee. You don’t pay a mortgage or other homeownership expenses such as property tax. If you decide to move elsewhere, you don’t have to sell a property that’s subject to the ups and downs of the real estate market.

2. You’ll Find Housecleaning a Breeze

Making sure your new home looks its best is quick and easy when it’s a small space. With fewer household items,you’ll spend less time vacuuming carpets and sofas, dusting surfaces and tidying up.

At Pomperaug Woods, we know you’re considering downsizing to an apartment for seniors because you have better things to do with your time. If that’s so, it might interest you to know we include weekly housekeeping and flat linen laundry service with your monthly fee.

3. You’ll Trim Down Your Possessions

Own a lawn mower? 12-foot ladder? Snow shovel? Time to sell these or give them away. Downsizing to an apartment for seniors forces you to declutter and get rid of things you no longer need. But downsizing is also very liberating. You’ll be less likely to fill up your new home with impulse buys, because you’ll have limited storage. Deciding what to keep and display in your living space means cultivating more intentionality about what’s truly important to you.

4. You Have More Opportunities for Socializing

Sometimes, living in a big house in the suburbs can feel isolated after children move out or if you live alone. Downsizing to a senior apartment puts you in the middle of a ready-made community of neighbors. You’ll have opportunities to meet new people your age when you work out in a fitness class, join a group for an outing or event, or take part in a community club or activity.

5. You’ll Economize on Home Expenses

Cleaning supplies, seasonal decorations, stockpiles of food or other items — you’ll simply spend less on these when you downsize. You won’t be paying for help to clean your home or repair appliances.

A smaller home minimizes your utility bill, since you’re not heating or cooling a large house with unused rooms. You also won’t need to foot property tax bills or HOA fees.

6. You Can Gift Precious Items to Your Family

Downsizing to an apartment for seniors is a great time to identify and pass down those prized possessions to your children and grandchildren. This way you get to share the stories behind why items are meaningful to you and get a kick out of knowing they’re appreciated by the next generation.

7. You Can Benefit Those in Need

Give your unused, unneeded, and unwanted appliances, furniture, clothes, and other household items to people who can really use them. Donations of secondhand belongings in good condition are always welcome at your local thrift stores, churches and shelters.

8. You Won’t Need to Drive as Often

Downsizing to an apartment for seniors puts you steps away from essential services and amenities.

At Pomperaug Woods, a fitness center, dining rooms and café, convenience store, banking and postal services, and full-service hair and nail salon are on our campus. You’ll also find a library, creative arts studio, billiards room, and a card and game room in the clubhouse. We offer door-to-door scheduled transportation to local shops and other venues, including to the Riverwalk Athletic Club or Heritage Country Club, where you’ll have membership privileges.

9. You’ll Reduce the Risk of a Fall

A home that was right for your family years ago may not be a safe choice for you now. Flights of stairs, dim lighting or slippery bathtubs become more hazardous as we age. You can remove these risks and greatly improve your quality of life by downsizing to an apartment for seniors that’s smaller, and more accessible. Choosing a floor plan without stairs, and with modifications already built in, such as a step-in bath or lower kitchen cabinets, can really improve quality of life.

10. You’ll Have Added Support When You Need It

As a resident of Pomperaug Woods, you’ll gain lifetime priority access to a continuum of on-site healthcare options. If you ever need help with activities of daily living, our assisted living program lets you determine which kinds of services and assistance you need. You can maintain your personal routines and enjoy maximum independence, knowing you’ll always get the right help at the right time.

Discover “The Art of Living Well”

Downsizing to an apartment for seniors doesn’t mean you’ll be getting less out of life. Far from it.

At Pomperaug Woods, you’ll find intriguing opportunities on every corner of our naturally beautiful 22-acre campus. The Art of Living Well, our innovative, research-based wellness program, provides classes and resources for your physical health, social engagement, and spiritual connection. It also deepens a sense of purpose and satisfaction with life through vocational and volunteer activities. Tour the variety of floor plans we have currently available. The sooner you move in, the sooner you can be part of the energizing Pomperaug Woods lifestyle. Call 203-262-6555 to learn more or schedule a personal tour.

Pomperaug Woods Featured on American Health Front, CBS News

Pomperaug Woods is home to intelligent, positive, creative people who define the art of living. One of the unique things about Pomperaug Woods is Life Care, giving residents peace of mind of not having to worry financially or about someone else caring for them. Pomperaug Woods believes the keys to healthy aging is to be socially connected and physically active by offering a cutting-edge art studio and fitness classes.

View the full story below to learn more about how Pomperaug Wood’s beautiful 22-acre property provides the setting to have a prosperous retirement.

Life Care Services Ranked #1 in Independent Living Customer Satisfaction by J.D. Power

Nation’s second-largest senior living operator receives highest score in all 6 factors

Pomperaug Woods is excited to announce our management company,Life Care Services, has become the first and only senior living company to rank first in customer satisfaction for three consecutive years among independent senior living communities in the J.D. Power 2021 – Senior Living Satisfaction Study. Life Care Services also achieved the highest score in all six factors of satisfaction: resident activities, community staff, price paid for services received, resident apartment/living unit, community building and grounds, and dining.

“Life Care Services is honored to be recognized by our customers as the best among independent senior living communities for the third consecutive year,” says Joel Nelson, president and CEO of LCS, the parent company of Life Care Services. “We are privileged to serve nearly 40,000 seniors across the nation. This recognition is meaningful because our residents recognize and value our commitment to serving them first and foremost, even as our industry navigated challenges over the past year.”

Life Care Services ranked highest in independent living resident overall satisfaction with a score of 817 in the J.D. Power U.S. Senior Living Satisfaction Study. The study is based on responses from residents living in an independent senior living community within the previous three years.

“For 50 years, our employees have been dedicated to creating opportunities for purposeful living filled with rich experiences,” added Nelson. “There is nothing better than seeing how our employees have impacted those we serve and how that dedication has made a difference for our residents and customers.”

What Does This Mean for our Residents?

We are deeply grateful to know that our hard work is valued, and we at Pomperaug Woods want to assure residents, family, friends and staff that we will continue to improve, evolve and innovate to provide the newest offerings to meet the needs of current and future residents.

If you’d like to know more about the way we enrich the lives of our residents, send us a message on our contact page.

Life Care Services received the highest score among independent senior living communities in the J.D. Power 2019-2020 U.S. Senior Living Satisfaction Study of resident/family member/friend’s satisfaction with senior living communities. Visit jdpower.com/awards for more details.

5 Financial Literacy Tips for Seniors in Retirement

As we reach retirement age and begin to navigate the years ahead, older adults often face issues such as how to maintain their lifestyle and pay for medical expenses on a fixed income. Will the wealth you’ve managed to accumulate fund your remaining years? There are only a few basic things you can do — make more, spend less, or try to achieve higher rates of return on the assets you already have. Well-prepared senior citizens will have developed an astute understanding of financial planning that includes saving and investing, spending and borrowing, getting organized with money management, and getting help when necessary. But achieving full financial literacy doesn’t happen overnight. It requires patient inquiry, discipline, and access to good information. These helpful tips will get you started.

Tip 1: Develop a spending plan.

No financially literate person at any age operates without a budget. Tracking your spending and seeing what you can adjust is always a good idea. Create a list of monthly expenses — food, personal items, insurance premiums, co-pays and medications, everything — and track your spending throughout the month. The goal is to know where every dollar is going. Look for new ways to cut costs, like letting your auto insurer know you no longer drive your car to work. Put some of your income into savings to avoid needing to make large, sudden withdrawals like buying holiday gifts or helping family members through a short-term crisis. You’re retired now and your spending patterns simply can’t be what they were during your working years. You can have automatic withdrawals from your bank account to routinely put a certain amount of money into a savings account or U.S Savings Bond.

Tip 2: Make it easier to manage money and pay bills.

These days, going paperless — banking and paying bills electronically — can save you time and money by avoiding late charges, service interruptions, and unnecessary trips to pay bills. There may even be discounts associated with online bill paying or having payments automatically transferred from your account. It’s important, though, that you promptly review each bill for accuracy, monitor your account balance, and keep the anti-virus and security software on your computer updated. If an error or fraudulent item appears on your statement, and you promptly report it to the bank, your liability is limited. But you have to be comfortable reviewing key communications from your bank and other service providers online and in a timely manner before you make the switch.

If you’ve accumulated multiple bank and investment accounts and credit cards over the years, consider closing those you no longer use or need. For payments you’re due to receive, such as money from pensions or tax refunds, there are benefits to having them automatically deposited into a low-cost or no-cost checking or savings account.

Tip 3: Find ways to keep earning.

Just because you’re an older adult who has retired from full-time employment doesn’t mean you can’t keep making money. Consider ways to bump up that monthly budget while keeping your savings intact. You might turn a hobby or other interest into a part-time job. Seasonal jobs or freelance consulting are also possibilities for retired senior citizens. But be sure to consider if making this extra money could affect other aspects of your financial planning, such as potentially increasing your Medicare costs or having possible implications for your income tax. Additional income will be taxable, and if you’re not sure how additional earnings would affect your tax status, consult a tax professional to avoid surprises when tax season comes around. One bit of good news is that when you reach full retirement age, your Social Security benefits won’t be affected by your earnings.

Tip 4: Understand the pros, cons and costs of annuities.

Annuities are financial products tied to a contract between a consumer and an insurance company. Insurers sell annuities, but so do other financial institutions, including banks. You buy an annuity by making either a single payment or a series of payments to the insurance company. In return, the company promises to make payments to you, either as one lump sum payment or a series of payments for a specified time period. Because there are different types of annuities and a mix of potential benefits and risks, it’s important to learn as much as you can before investing. A good place to start is the U.S. Securities and Exchange Commission’s website or by calling the SEC toll-free at 1-800-732-0330. Of course, your financial advisor can clarify how annuities work and address your questions.

Tip 5: Organize and protect important documents.

Make sure your credit cards, checkbooks and other financial records are securely protected. Items to keep at home in a secure, easily accessible place may include bank and brokerage statements, insurance policies, Social Security and company pension records, and other personal and financial documents you or your family might need on short notice. A safe deposit box is best for storing documents or valuables that could be difficult or impossible to replace. These might include originals of birth certificates, property deeds and car titles. Think twice before using a safe deposit box for an original of a will or power of attorney, because it may not be possible for loved ones to access them quickly if you become incapacitated or pass away. For guidance on where to store these documents, check with an attorney about what is required or recommended based on state law.

Regardless of where you keep important documents, seal them in airtight and waterproof plastic bags or containers to prevent water damage. In case of fire or natural disaster, you may want to prepare one or more emergency evacuation bags with essential financial items and documents, such as some cash and checks, copies of your credit cards and identification cards, and a key to your safe deposit box.

Where to find additional help and guidance.

Regardless of your age, you can improve your financial literacy and learn more about managing money, banking products and services – and your rights as a consumer – exploring the sites shown below. You’ll also see resources for finding local assistance and information on topics such as legal issues.

· Look here for resources from more than 20 federal agencies, including the FDIC.

· Find Consumer Financial Protection Bureau (CFPB) information for seniors on a wide range of topics here.

· See resources for finding local assistance at the U.S. Administration on Aging’s website here.

Financially savvy seniors choose Pomperaug Woods.

Pomperaug Woods is home to intelligent, positive, creative people who define the art of living. They know our community’s not-for-profit ownership affords them all the rewards that come with local executive leadership and a local board of directors committed to directing profits back into our community through continual updates and improvements. If you’d like some guidance in your search for senior living, we invite you to consider us a source of information and ideas. Reach out with questions any time or contact us to arrange your personal tour.